When you need a quick solution to your financial needs, unsecured loans can be a great way to help you out in the short term. Whether it is due to a financial crisis, an unexpected bill, or an unforeseen maintenance cost, an unsecured loan in the UK is easy to apply for with LoanPig. This fast cash solution can alleviate any issues you may be having at present, helping you to get back on track. Providing you with the flexibility to choose the loan amount and repayment term you need, you can borrow up to £1500 with an unsecured loan, which can be paid back in one repayment or spread over 12 months. We also have the ability to connect you to other direct lenders if we can’t approve your application. Unsecured loans are great in the short term, and if you have the affordability, we can pass your details on to our panel of lenders, or even help you out ourselves.

Click apply now for unsecured loans in the UK and once approved it’s possible for you to acquire the funds to use on the same day.

What Are Unsecured Loans?

Unsecured loans in the UK come in various forms and can be anywhere between £50 – £1500, with a repayment period between 2 – 12 months. Payday loans and short term loans are types of unsecured loans and they have a fixed price, over a chosen amount of time, making them a great option when you are facing a financial emergency. Unliked unsecured loans, secured loans involve you offering a personal asset which you will usually be able to borrow up to half the value of. Rather than repossessing an asset if you are unable to keep up with the repayment, an unsecured loan allows people with short-term cash flow issues to resolve their financial problem, without having to worry about repossession of assets.

Unsecured loans can be the perfect solution for when you need some quick cash in order to cover an immediate problem. When you apply for an unsecured loan, the money is transferred into your account as quickly as possible, usually within a few minutes and almost certainly on the same day. As a responsible lender, we will only provide you with an unsecured loan if we believe that you can afford to pay it back.

Why Might I Need An Unsecured Loan?

As a means of alleviating financial difficulties on a temporary basis, an unsecured loan can be used for a variety of reasons to help you get through whatever financial issue you’re currently experiencing. Short term unsecured loans are designed for those who can afford to pay them back as soon as they say they will within the application process. Once you have applied, we will assess certain criteria in order to deem you eligible for a fast, unsecured loan. With LoanPig, we will provide you with a range of options in choosing an unsecured loan, including instalment loans, sameday loans and more. We provide access to unsecured loans when you need money quickly. The reasons that borrowers come to us to acquire an unsecured loan often differ, but it can be for a whole array of different reasons. Our unsecured loans can be applied for with our transparent application process, which you can carry out online. As an FCA authorised broker of unsecured loans, we can quickly show you the best unsecured loans in the UK from our panel of lenders.

Benefits Of Taking An Unsecured Loan With LoanPig

At LoanPig, we strive to help you resolve your financial problem as soon as possible. We can help you find an unsecured loan in minutes, tailored to both how much you need to borrow and how long you require the repayment period to be. We are here to help, which is why we make sure that when you arrange an unsecured loan, you are able to comfortably afford the repayments, rather than enhancing upon your difficulties.

Benefits of taking an unsecured loan with LoanPig include:

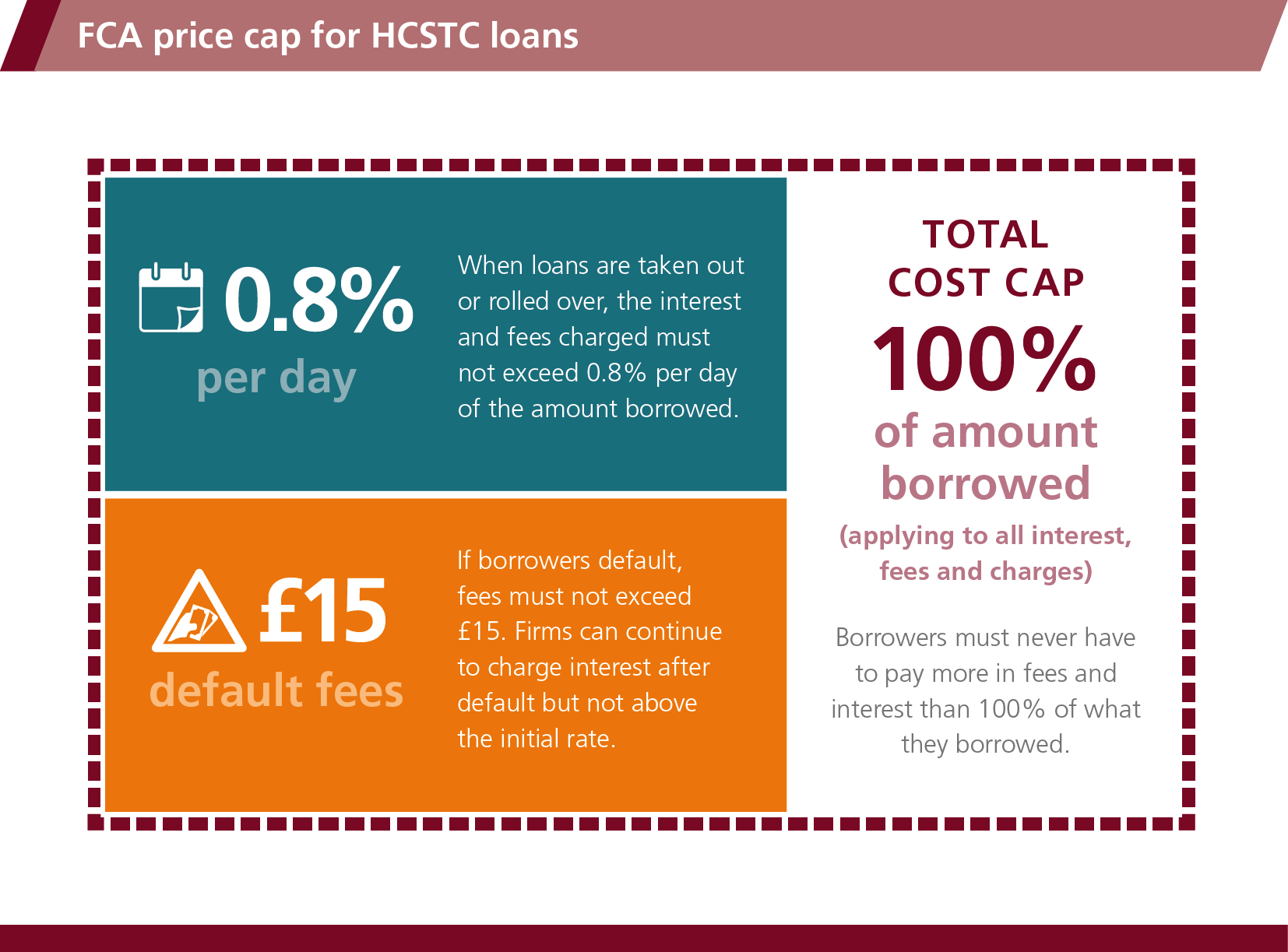

– LoanPig charges a maximum interest of 0.8% per day.

– LoanPig can only charge a one-time late penalty fee of £15.

– We ensure that customers will never pay more than double the amount they borrowed.

– We work with a friendly, responsive customer care team who are here to help.

– The application process, approval, and cash transfer take place quickly for unsecured loans, with many applicants receiving the cash on the same day they apply.

Hopefully, we can approve your unsecured loan application. When this has been approved, you can expect a quick pay out, allowing us to give you the financial support you require within minutes.

Am I Eligible For An Unsecured Loan?

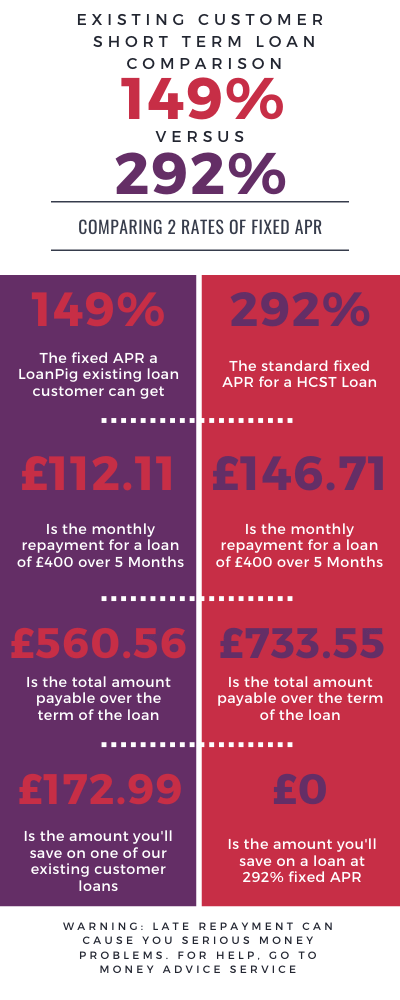

LoanPig provides a handy loan payment calculator, allowing you to choose the amount you would like to borrow, and the length of time you wish to span the repayments over. It can provide you with a breakdown of how much your unsecured loan will cost compared to other lenders. This includes APR and interest. With no hidden fees, and a completely transparent process. When applying for an unsecured loan with LoanPig, you can be sure that you are with a trusted provider.

Applying for an unsecured loan in the UK with LoanPig is an online process, making it accessible to practically anyone. Once you have applied, you will then be shown an estimation of your monthly repayment amount. If you are happy with the unsecured loan terms, you can proceed. To be eligible for unsecured loans in the UK, you’ll need to be:

– A current UK resident.

– At least 18-years-old.

– Have an active bank account and a valid debit card.

– In permanent employment or receiving some form of disability/living allowance or pension.

If you have any further concerns regarding prior financial difficulties, you have a bad credit rating or have never borrowed before, you don’t need to worry. As a broker, LoanPig uses a panel of lenders. Many of these are willing to lend to clients who have a low credit score. All unsecured loan applications are subject to a full credit check, but your credit score is not the only criteria used to consider your application.

Unsecured Loan Stages

Step 1 – Application

To begin the process to acquiring a unsecured loan in the UK, you must always begin with an application. Fill out our online application, let us know how much you need, and how long for. You will also be required to provide us with some further details about you and your current situation.

Step 2 – Decision Process

After submitting your information, you’ll receive a decision on the very same day. We’ll provide you with our decision, along with multiple options for your unsecured loan, so you can relieve any difficulties you may be having for the time being.

Step 3 – Payment

When you have accepted the loan and agreed to all of the attached conditions, the money will be sent directly to your bank account. The length of time this takes may vary, but many customers receive their unsecured loans within 10 minutes of signing the agreement.

Apply For An Unsecured Loan With LoanPig

Using our accessible, easy to use online application form, you can get an unsecured loan within minutes. We advise that you fill out our application form in full and answer are as truthful as possible. This is so we can accurately decide whether you are eligible for our unsecured loans, as well as deciding which of them would best suit you. Whatever you are looking for, we are certain to have everything that you need all in one place. Apply today to get started.

Unsecured Loans In The UK FAQs

What’s the Longest Term I Can Choose for an Unsecured Loan?

At LoanPig, we offer a flexible approach. You can choose unsecured loans anywhere between 1 – 12 months. We will match you with the lender best suited to you and strive to get you the best unsecured loan deal in the UK.

Do I Need A Guarantor For An Unsecured Loan?

At LoanPig, we like to keep things as simple as possible. Similar to our no guarantor loans, we offer unsecured loans with no collateral and no required guarantor. If you have the financial capacity to afford the unsecured loan, and aren’t in any form of long-term financial difficulty, you shouldn’t face any issues within your application.

Can I Get An Unsecured Loan With Bad Credit?

Bad credit can be an issue with some lenders of unsecured loans in the UK. At LoanPig, we don’t believe your financial history should be the be-all and end-all when applying for an unsecured loan. We will simply assess your credit history to see if you have received regular income within the last few months, as well as analysing any outgoing payments, such as rent, bills and mortgage payments. If you have enough current affordability to make repayments over the time span you have requested, we will happily approve your application.