As a both a broker and a direct lender, we allow you to compare loans in the UK to find the best option for you. At LoanPig, we offer various different types of loans, allowing you to decide upon what loan is best suited to you based on a variety of factors. When you compare loans online, you are able to filter out what the best option is for you and your personal requirements, so whenever you find yourself in a financial crisis, whatever the reason, you can compare loans online with LoanPig to attempt to resolve the issue.

If you need cash fast to cover an unexpected bill or other financial emergency, LoanPig can quickly help you resolve your situation. With a fast application process providing you with the flexibility to choose the amount and repayment term you need up to £1500, our instant payday loans online can be paid back in one repayment or spread over 12 months. By clicking apply now, you can begin your loan application and find the best loan for you.

How To Compare Loans In The UK

At LoanPig, we streamline the loan comparison process in the UK, so you can find exactly what you are looking for. LoanPig allows you to compare short term loans, making it easy to secure short term credit as quickly and as securely as possible. There are many different types of loans and it’s important to work out which type is right for you, rather than applying for the first loan you come across. By working out which loan is right for you, we can compare loans in the UK to get you the best deal.

Our loan comparison process always begins with an application, so you can tell us what you’re looking for. This is inclusive of information regarding how much money you’re looking to borrow, the length of time you would like to make repayments over, and what you need the loan for. This will allow us to begin to compare loans online and find the best option for you. You will also require to provide us with some further details about you and your current financial situation, along with personal details such as your name, address and date of birth.

Loan Comparison In The UK: Different Types Of Loan

Different types of loans are applicable for different personal requirements, which is why it is extremely beneficial to compare loans online. When looking for a short term loan, it’s always a good idea to be aware of what different loan companies can offer you. Also, which the best choice is when it comes to you and your personal finance needs. The amount you need to borrow, coupled with the rate at which you wish to repay is likely to be the biggest deciding factor in choosing a particular lender. Our loan comparison process in the UK evaluates various loan options, inclusive of:

Payday loans are a type of emergency cash loan where you borrow a small sum of money over a short period of time. Payday loans online are a form of unsecured borrowing, meaning none of your personal property will be tied into the agreement. They are designed for those emergency moments where you may need quick cash to tide you over until your next payday and you don’t have any other means to pay, such as using savings or available credit.

Short term loans in the UK are not the same as a payday loan, which is repayable in full by your next salary date. Thanks to their flexibility, you can repay short term loans earlier with no penalties, something we offer as well as the lenders we can connect you with. They are designed for short term situations only so are not suitable for those with long term financial difficulties. We also do not offer short term loans with no credit check as this needs to be performed as part of your application. As responsible lenders, we need to ensure your credit file is checked to help us assess your finances fully.

Same day loans are an alternative option to a traditional short term loan, as you are able to receive your funds within just 24 hours. At LoanPig, we pride ourselves on remaining flexible for our customers to ensure that you can obtain the amount of cash that you need, as quickly as you need it. Our flexible repayment options ensure that you can arrange your repayments around what suits your income best, so if you can afford to repay quicker than 12 months you can do so. Same day cash loans are fast to apply for as the whole process is completed online. You won’t have to wait for paperwork to be sent to you, instead, the signing of documents is done electronically. This is a huge time-saver when you need money fast.

Same day loans differ slightly from payday loans as you have the flexibility to spread repayments further. Rather than being restricted to paying back in full by your next salary date, you can choose between 2 to 12 months to repay your loan. This can make having the loan much more affordable as the repayments will be smaller to manage, ensuring you can maintain them.

If you have applied for any form of credit such as a loan, credit card or even a mortgage, you’ll know how important your credit score is to the lender. They use the information in your credit report to decide on what rate to offer you and whether they are able to accept your application. Having a bad credit finance history will influence the lender’s perception of your ability to repay the loan, even if your finances are much healthier today. Here at LoanPig, our bad credit loans are designed for people with a bad credit history. We look further than your bad credit rating when assessing your loan application, focusing more so on your affordability and current financial status. If you are unsure if you’re an eligible candidate for credit and have been declined elsewhere, we can compare loans in the UK and find the best option for you.

Cash loans can be described as a small or unsecured loan amount that provides extra cash to cover a financial emergency or unexpected expense. A cash loan is transferred to your bank account after approval. You can then withdraw or use the funds to resolve your situation quickly. Despite knowing we all should expect the unexpected, even the best-made plans can quickly change, meaning very quickly money can be tight when you need it most.

No guarantor loans refer to a type of unsecured loan that requires no-one to co-sign the agreement as a guarantor. Requiring only a sole applicant, you can apply for loans without guarantor if you have good or bad credit, meaning they can be ideal for those who have struggled to find finance options online elsewhere. Usually when you have a low credit score, a lender may request that you provide a guarantor, who can be someone such as a relative or friend that isn’t already financially linked to you, who guarantees the loan for you. You would have to find someone who has a good credit score who is willing to take on this responsibility in the event you could no longer afford the loan.

Compare Loan Lenders In The UK

A short term loan direct lender is one that allows you to apply directly on their website. They will also process your application and fund your loan. As a direct lender as well as broker, we can offer the best of both worlds. This can be a huge advantage compared to other loan lenders. Get ready to start your application and compare the various loans available for you. Apply online and if successful, you can receive funds within 1 hour or on the same day of applying. Comparing loans to find the most suitable option for you needn’t be difficult or cause you to struggle with repayments. With LoanPig, you are always in control of your finances.

Compare Loans In The UK FAQs

Compare Loans Online: Why Take Out A Loan?

Finding the right loan for you doesn’t have to be tricky, and when you compare loans online with LoanPig, we can find the best deal for you to help you cover issues such as emergency expenses, unexpected bills and any other unforeseen financial payments you may need to cover. These can range from home repairs, emergency travel funds, late payments fees, and more.

Why Take Out A Loan With LoanPig?

As responsible lenders, we have to ensure that your motivation for a loan can be supported by your finances. Along with being one of best loan comparison sites in the UK, we also want you to be as comfortable as possible in making your repayments. As we work to FCA guidelines, along with our panel of loan lenders we can connect you with, your application will be subject to a full credit check and careful assessment of your finances. As part of our commitment to transparency with your application, we work to several rules:

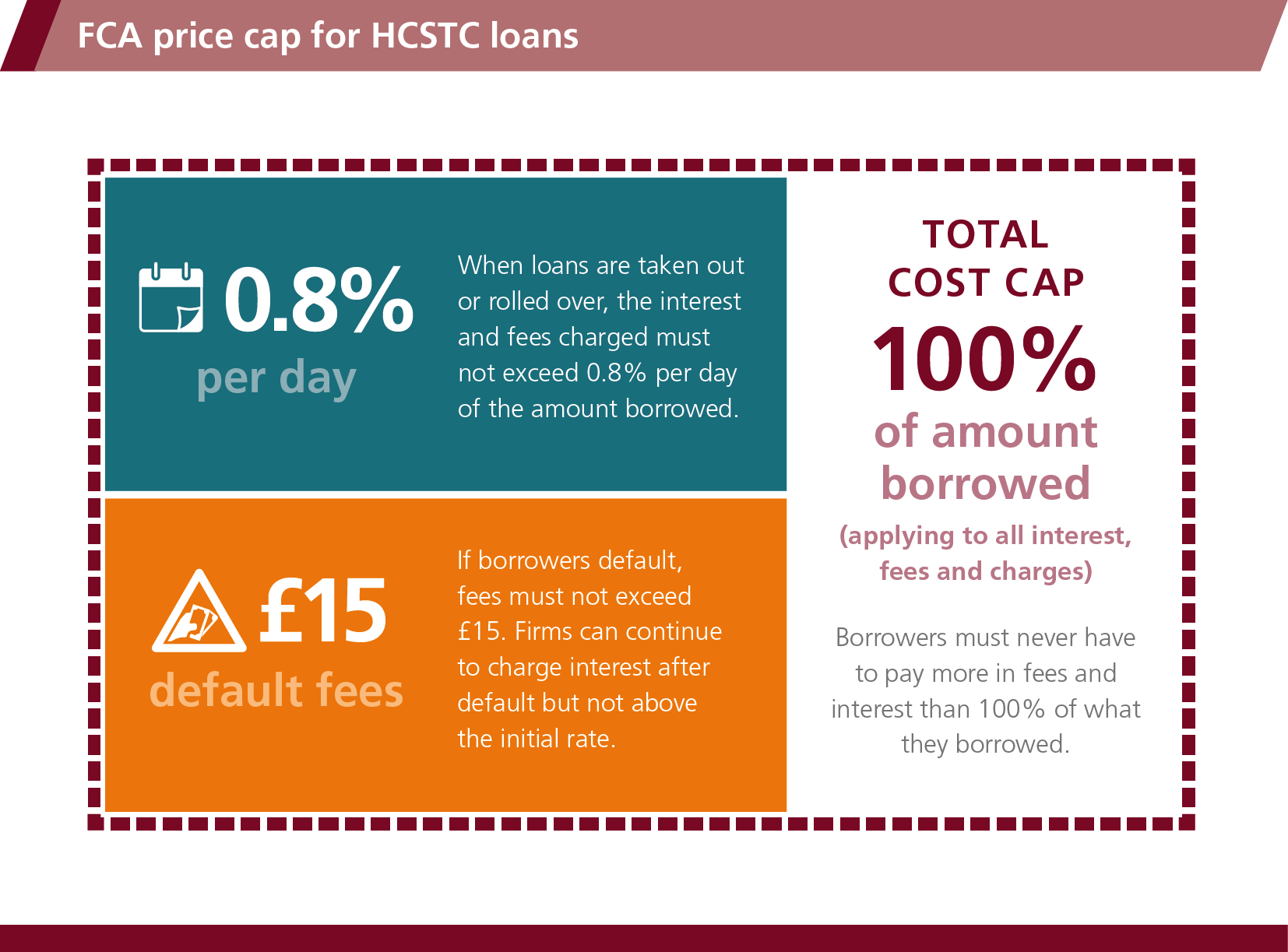

- LoanPig charges a maximum interest of 0.8% per day.

- LoanPig can only charge a one-time late penalty fee of £15.

- LoanPig ensures that customer will never pay more than double the amount they borrowed.

If we can approve your loan application following the loan comparison process, you can expect a quick pay out and the exact financial support you need in an instant.